Press Release

July 20, 2015, 8:00 AM EDT

Mobile Technology Use Among Shoppers Rises as Retail Habits Change, Synchrony Financial Study Finds

Retailers can differentiate themselves with integrated mobile strategies

Dateline:

STAMFORD, Conn.

Public Company Information:

NYSE: SYF

STAMFORD, Conn.--(BUSINESS WIRE)--Synchrony Financial (NYSE:SYF), a premier consumer financial services company with 80 years of retail heritage, today released findings from its 2015 Digital Study that further confirm the importance of a comprehensive mobile strategy for retailers to effectively engage shoppers and enhance the customer experience.

The survey, conducted in March and April 2015 with nearly 7,000 Synchrony Bank cardholders and random shoppers nationwide, gathered insights on how customers view mobile technology for shopping and what they expect in their mobile retail experience. Key findings of the third annual study include:

- Almost 50% of survey respondents are now shopping using a mobile device.

- Almost one-third are purchasing a product after seeing it on social media.

- Approximately one-third of survey respondents indicate that text offers would drive an incremental shopping visit.

- Value propositions, including free shipping, loyalty programs and personalized offers, continue to be important.

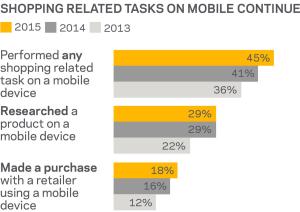

Results show that the use of mobile technology by shoppers continues to climb, with adoption growing among key segments of the population – 45% of all respondents said they used a mobile device to perform a shopping-related task (researching, sharing, purchasing and reviewing) in 2015, up four percent from 2014, and nine percent from 2013.

As mobile usage increases among all shoppers and across all devices, retail habits are changing. Mobile device usage for purchases is steadily increasing – 18% of respondents now report using a mobile device to make a purchase, up from 16% in 2014, and 12% in 2013.

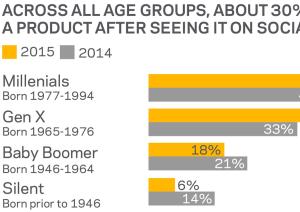

Social media continues to be an important channel for retailers to drive sales and engage with customers. With 85% of consumers accessing social media and 45% following brands via social media channels, social media is important to driving engagement. Thirty percent of all age groups report purchasing a product after seeing it on social media and the numbers are higher for younger shoppers – 52% of Millennials and 42% of Gen Xers.

Holders of Synchrony Bank retail credit cards are more digitally-enabled than other shoppers and increasingly using mobile functionality for mobile credit card applications (+114% growth over 2014), mobile service logins (+58%), and mobile payments (+72%). Cardholders also have more access to mobile technology, making them particularly important to a retailer’s overall marketing strategy. The study shows:

- 85% of retail cardholders own a smartphone v. 69% of random national sample.

- 69% of retail cardholders own a tablet v. 45% of random national sample.

- 64% of retail cardholders own a smartphone and tablet v. 37% of random national sample.

“It’s clear from our research that shoppers across every segment are becoming more mobile-enabled and savvy, using all digital resources available to them to shop and purchase in and out of the store,” said Toni White, chief marketing officer, Synchrony Financial. “Retailers who focus on creating an integrated customer experience across all channels can differentiate themselves.”

Tips for retailers to engage digital customers start with satisfying the needs of omni-channel shoppers for a simple and easy experience and a website that is optimized regardless of the device a customer is using. In addition to responsive design, factors influencing shopper interest and loyalty include: enhanced wish lists; drag & drop clipboards; and custom alerts, signaling a sale or availability of their favorite item. These steps can provide immediate and personalized offers that reward shoppers for their loyalty.

The Synchrony Financial Market Research team provides insights into consumer attitudes and perceptions toward the retail brand, products and platforms to improve customer satisfaction. Through the Synchrony Connect program, Synchrony Financial partners can connect with subject matter experts to gain knowledge and expertise in noncredit areas that help them grow, lead and operate their business. More information can be found at www.SynchronyFinancial.com.

About Synchrony Financial

Synchrony Financial (NYSE: SYF), formerly GE Capital Retail Finance, is one of the nation’s premier consumer financial services companies. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables*. We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations, and healthcare service providers to help generate growth for our partners and offer financial flexibility to our customers. Through our partners’ over 300,000 locations across the United States and Canada, and their websites and mobile applications, we offer our customers a variety of credit products to finance the purchase of goods and services. Our offerings include private label and co-branded Dual Card credit cards, promotional financing and installment lending, loyalty programs and FDIC-insured savings products through Synchrony Bank. More information can be found at www.synchronyfinancial.com and twitter.com/SYFNews.

*Source: The Nilson Report (April, 2015, Issue # 1062) - based on 2014 data.

Topics: Retail, credit cards, shopping, mobile commerce, mobile payments, smartphones, tablets, digital

Editor Note: Graphic data representations are available.

©2015 Synchrony Bank/Synchrony Financial, All rights reserved.

Contact:

For Synchrony Financial

(855) 791-8007

media.relations@synchronyfinancial.com