White Paper

August 19, 2015, 4:29 PM EDT

Balancing Multi-Generational Retail Strategies

DOWNLOADAuthor

Contributors

Abstract:

Table of Contents

Millennials, Boomers and the changing retail landscape

But, with Millennials growing in number and purchasing power, retail strategies must start to focus on this generation in order to be successful.

* U.S. Census Bureau, Population Division. Release date June 2015.

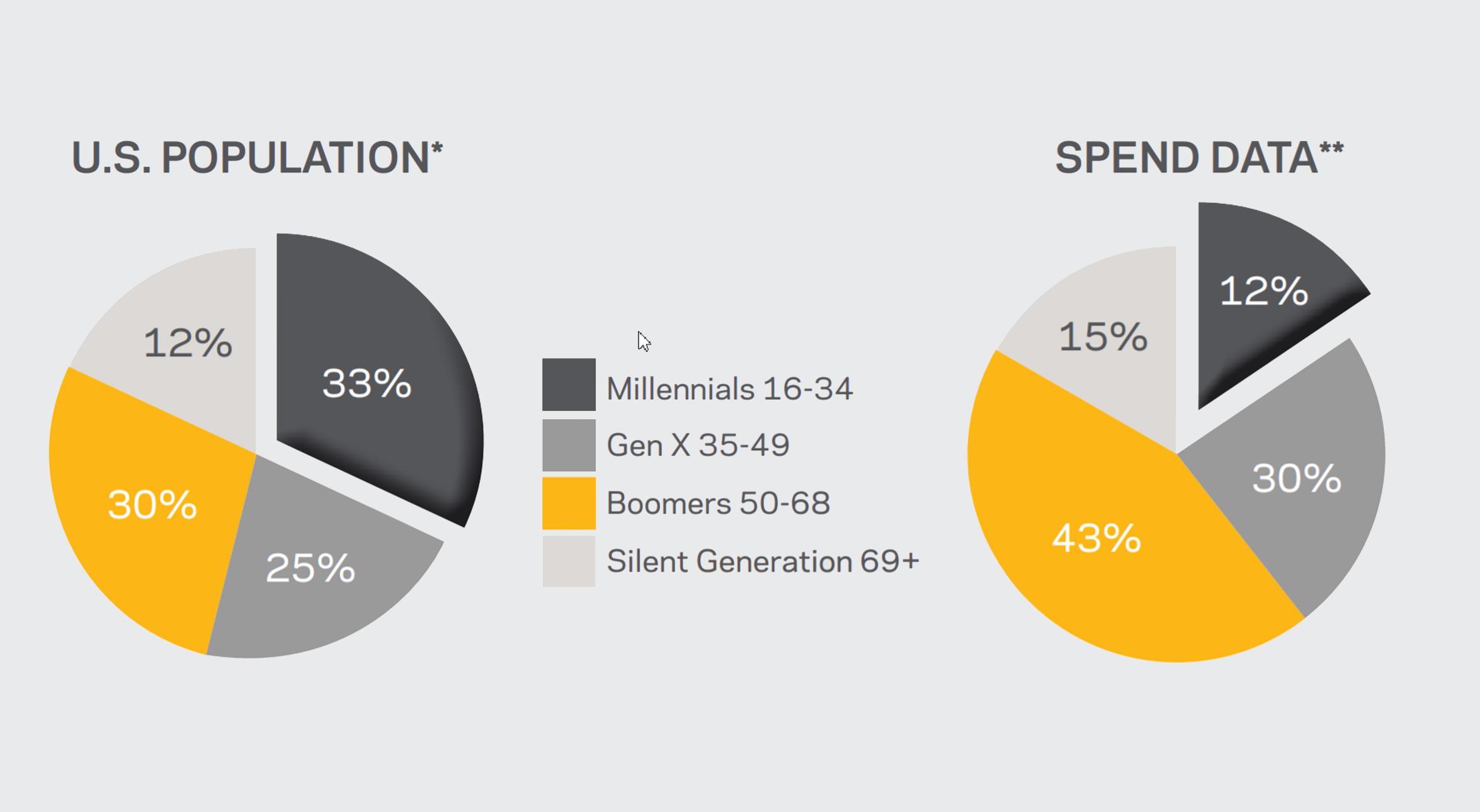

A sampling of our sales data on retail store branded credit cards across a number of retail verticals shows that even though the population of Millennials (those born 1980 - 1998) has now outgrown the Boomers, Boomers significantly outspend Millennials:*

* Annual Estimates of the Resident Population by Single Year of Age and Sex for the United States: April 1, 2010 to July 1, 2014. Source: U.S. Census Bureau, Population Division. Release Date: June 2015

** Synchrony Financial Analytics, May 2014 - April 2015 data on credit cardholders based on sales from 73 retailers.

A strategy focused on Boomers may need to evolve into a strategy more inclusive of a wider population. Millennials are quickly becoming a shopping force of their own. Although not yet spending in large amounts, Millennials are now the largest generation in the U.S. workforce, and 80MM of them are entering their peak consumption years.*

There is no shortage of information and analysis on the Millennial population. White papers, academic studies, customer research and social listening abound. Millennials have been analyzed for their thoughts, feelings, likes, dislikes, charity, diversity, shopping habits, debt levels, etc.; yet, actionable insights about what drives their behavior have proven more elusive. This often leads to a wide range of opinions on the subject, from “Ignore them, they have no money anyway,” to “Drop everything and focus solely on Millennials”.

One thing is certain, Millennials are here to stay. And so are the GenX and Baby Boomer populations. Boomers still have the most disposable income and over 40% of retail sales compared to about 12% for Millennials. As a result, this white paper will focus on multi-generational marketing. Any other approach would be significantly one-sided.

* Richard Fry. “Millennials surpass Gen Xers as the largest generation in U.S. labor force.” Pew Research Center, Washington, D.C. (May 11, 2015).

Two generations, one unified brand experience

similarities and differences in the way the two generations shop. The data below summarizes these findings.

- Take advantage of discount offers: 69% Millennials, 63% Boomers

- More likely to purchase if they have a loyalty discount or coupon: 66% Millennials, 63% Boomers

- Have made an online purchase from a retailer: 89% Millennials, 81% Boomers

- Made a purchase online with a retailer in the past 3 months: 89% Millennials, 81% Boomers

- Have researched a product online in the past 3 months: 90% Millennials, 81% Boomers

- Own a mobile phone: 97% Millennials, 88% Boomers

- Own a tablet: 50% Millennials, 44% Boomers

Myth Busters

1. Millennials and Boomers use digital devices differently.

Millennials are much more likely to use their digital devices for a wide variety of shopping related tasks. Boomers have the devices, but are much less likely to use them as interactively for shopping.

- Percent stating they Like or Follow brands on social media:

- Millennials 67%, GenX 83%, Baby Boomer 38%, Silent 21%

- Percent stating they purchased a product after seeing it on social media:

- Millennials 52% 2015 41% 2014, GenX 42% 2015 33% 2014, Baby Boomer 18% 2015 21% 2014, Silent 6% 2015 14% 2014

Crowdtap survey, May 2015.

When analyzing purchase drivers for the Baby Boomer population, the focus would naturally be on in-store promotions.

For the electronics category, when looking at purchase drivers for Boomers alone, in-store promotions are the top driver of purchases, closely followed by TV and email.

When purchase drivers for Millennials are analyzed, in-store promotions and internet ads are much more important in driving purchases.

The decision of where to spend marketing dollars is different when adding potential spenders (Millennials) into the framework.

*NRF Media Behaviors and InfluenceTM Study. January 2015.

- Understand what channel drives the purchase decision for the Baby Boomer, as well as the Millennial shopper.

- Ensure your brand looks at media and advertising encompassing both traditional, as well as digital media to include all generations.

- Shipping items from store to customer

- In-store kiosk for online ordering

- Access to Wish Lists and Online Shopping Baskets

Conclusion

Both can exist in one seamless retail experience. Several strategies can be used to ensure the retail experience effectively engages both generations.